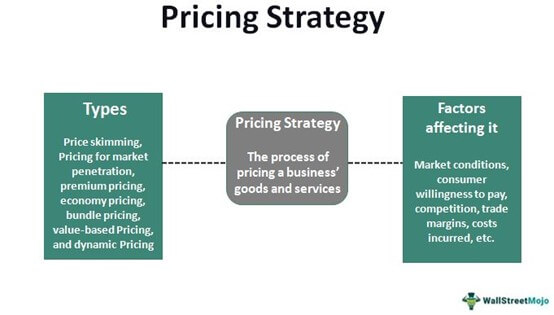

The Yes Premia Credit Card is a premium offering from Yes Bank, designed to cater to the needs of affluent customers who seek a blend of luxury and practicality in their financial products. This credit card stands out in a crowded marketplace by providing a suite of features that not only enhance the cardholder’s purchasing power but also offer exclusive privileges that elevate the overall banking experience. With a focus on lifestyle benefits, travel perks, and rewards, the Yes Premia Credit Card is tailored for those who appreciate the finer things in life while also valuing financial flexibility.

In an era where credit cards have become essential tools for managing personal finances, the Yes Premia Credit Card positions itself as a versatile option for individuals who frequently travel, dine out, or shop. The card is not just a means of payment; it is a gateway to a world of exclusive experiences and rewards. By understanding the various features and benefits associated with this credit card, potential users can make informed decisions about whether it aligns with their financial goals and lifestyle preferences.

Key Takeaways

- Yes Premia Credit Card offers a range of benefits and rewards for cardholders, making it a popular choice for many consumers.

- Cardholders can enjoy exclusive rewards and offers, as well as manage their account easily through the Yes Premia Credit Card platform.

- To apply for the Yes Premia Credit Card, individuals can visit the official website or apply through other designated channels.

- The card comes with certain fees and charges, which individuals should be aware of before applying for the card.

- Overall, the Yes Premia Credit Card is a great option for those looking to maximize their rewards and enjoy exclusive benefits.

Benefits of Yes Premia Credit Card

One of the most compelling aspects of the Yes Premia Credit Card is its extensive range of benefits that cater to diverse customer needs. Cardholders enjoy a generous rewards program that allows them to earn points on every transaction. These points can be redeemed for a variety of options, including merchandise, travel bookings, and even cashback.

The card typically offers higher reward points for specific categories such as dining, travel, and online shopping, making it an attractive choice for those who frequently engage in these activities. In addition to the rewards program, the Yes Premia Credit Card provides complimentary access to airport lounges across India and select international locations. This benefit is particularly appealing for frequent travelers who value comfort and convenience while waiting for flights.

Furthermore, cardholders can take advantage of exclusive discounts and offers at partner hotels, restaurants, and retail outlets, enhancing their overall spending experience. The card also includes travel insurance coverage, which adds an extra layer of security for those who travel often, ensuring peace of mind during their journeys.

How to Apply for Yes Premia Credit Card

Applying for the Yes Premia Credit Card is a straightforward process that can be completed online or through physical branches of Yes Bank. Prospective applicants must first ensure they meet the eligibility criteria, which typically include a minimum income requirement and a good credit score. Individuals with a stable income and a history of responsible credit usage are more likely to be approved for this premium card.

To initiate the application process online, applicants can visit the official Yes Bank website and navigate to the credit card section. Here, they will find detailed information about the Yes Premia Credit Card along with an online application form. The form requires personal details such as name, address, income information, and employment details.

After submitting the application, it usually takes a few days for the bank to process it and communicate the decision. For those who prefer a more personal touch, visiting a local Yes Bank branch allows applicants to speak directly with bank representatives who can guide them through the application process and answer any questions they may have.

Exclusive Rewards and Offers for Yes Premia Credit Cardholders

| Exclusive Rewards and Offers for Yes Premia Credit Cardholders |

|---|

| 1. Cashback on dining, groceries, and fuel |

| 2. Complimentary airport lounge access |

| 3. Bonus reward points on select spends |

| 4. Discounts on movie tickets and entertainment |

| 5. Special travel offers and discounts |

The Yes Premia Credit Card is synonymous with exclusive rewards that enhance the lifestyle of its holders. One of the standout features is the accelerated reward points system, where cardholders earn additional points on specific categories like dining and travel. For instance, dining at partner restaurants can yield up to 10x reward points, making it an excellent choice for food enthusiasts who enjoy exploring new culinary experiences.

These points can be redeemed for various rewards, including flight tickets, hotel stays, or even luxury goods from renowned brands. Moreover, Yes Bank frequently collaborates with various brands to provide limited-time offers and discounts exclusively for Yes Premia cardholders. These partnerships often include high-end retailers, travel agencies, and lifestyle brands, allowing cardholders to enjoy significant savings on their purchases.

Additionally, special promotions during festive seasons or holidays further enhance the value proposition of this credit card. Such exclusive offers not only incentivize spending but also create opportunities for cardholders to indulge in experiences they might not have considered otherwise.

Managing Your Yes Premia Credit Card Account

Effective management of a credit card account is crucial for maintaining financial health and maximizing benefits. The Yes Premia Credit Card comes equipped with an intuitive online banking platform that allows cardholders to monitor their transactions in real-time. Through this platform, users can view their statement history, track reward points earned, and manage payments seamlessly.

This level of transparency helps cardholders stay informed about their spending habits and ensures they remain within their budget. Additionally, the mobile banking app provided by Yes Bank offers features such as bill payment reminders and alerts for due dates, which are essential for avoiding late fees and maintaining a good credit score. Cardholders can also set spending limits or receive notifications when they approach their credit limit, promoting responsible usage.

By leveraging these digital tools, users can take control of their finances while enjoying the myriad benefits that come with their Yes Premia Credit Card.

Yes Premia Credit Card Fees and Charges

While the Yes Premia Credit Card offers numerous benefits, it is essential for potential applicants to be aware of the associated fees and charges. Like many premium credit cards, it typically comes with an annual fee that may vary based on promotional offers or customer loyalty programs. This fee is often justified by the extensive rewards and privileges that accompany the card; however, prospective users should evaluate whether these benefits align with their spending habits.

In addition to the annual fee, cardholders should also be mindful of other charges such as late payment fees, cash withdrawal fees, and foreign transaction fees. Late payment fees can accumulate quickly if payments are not made on time, potentially negating some of the rewards earned through spending. Similarly, cash withdrawals using the credit card may incur higher interest rates compared to regular purchases.

Understanding these fees is crucial for managing costs effectively and ensuring that the benefits of holding a Yes Premia Credit Card outweigh any potential drawbacks.

Tips for Maximizing Rewards with Yes Premia Credit Card

To fully leverage the rewards potential of the Yes Premia Credit Card, cardholders should adopt strategic spending habits that align with the card’s benefits. One effective approach is to focus on categories that offer accelerated reward points. For example, if dining out yields 10x points at partner restaurants, making dining a primary expense can significantly boost reward accumulation.

Planning meals at these establishments not only enhances dining experiences but also maximizes point earnings. Another tip is to stay informed about seasonal promotions or limited-time offers from Yes Bank or its partners. By keeping an eye on these promotions through newsletters or the bank’s mobile app, cardholders can take advantage of additional discounts or bonus points opportunities.

Additionally, utilizing the card for larger purchases—such as travel bookings or electronics—can lead to substantial point accumulation due to higher spending limits in these categories. By being strategic about spending patterns and staying engaged with promotional offerings, users can optimize their rewards experience with the Yes Premia Credit Card.

Is Yes Premia Credit Card Right for You?

Determining whether the Yes Premia Credit Card is suitable for an individual depends on various factors including lifestyle preferences, spending habits, and financial goals. For those who frequently travel or dine out and appreciate luxury experiences, this credit card offers compelling benefits that can enhance everyday life while providing significant rewards. The combination of exclusive offers and comprehensive travel perks makes it an attractive option for affluent consumers seeking both convenience and value.

However, potential applicants should carefully consider their ability to manage credit responsibly and weigh the associated fees against the benefits offered by the card. For individuals who may not utilize the premium features or who prefer lower-cost alternatives without annual fees, other credit cards might be more appropriate. Ultimately, understanding personal financial needs and aligning them with the offerings of the Yes Premia Credit Card will help individuals make informed decisions about whether this premium credit card aligns with their lifestyle aspirations.

FAQs

What are the benefits of the Yes Premia Credit Card?

The Yes Premia Credit Card offers a range of benefits including reward points on every transaction, complimentary lounge access, fuel surcharge waiver, and exclusive discounts on dining, shopping, and travel.

What are the eligibility criteria for the Yes Premia Credit Card?

The eligibility criteria for the Yes Premia Credit Card may vary, but generally, applicants should have a good credit score, meet the minimum income requirement, and have a stable source of income.

What is the annual fee for the Yes Premia Credit Card?

The annual fee for the Yes Premia Credit Card may vary, but it is typically in the range of a few thousand rupees. Some banks may offer a waiver on the annual fee for the first year.

How can I apply for the Yes Premia Credit Card?

You can apply for the Yes Premia Credit Card online through the bank’s website or by visiting a branch. You will need to fill out an application form and provide the necessary documents such as proof of identity, address, and income.

What is the credit limit for the Yes Premia Credit Card?

The credit limit for the Yes Premia Credit Card is determined by the bank based on the applicant’s creditworthiness, income, and other factors. It may vary from individual to individual.