DMI Finance is a prominent financial services provider in India, offering a range of loan products tailored to meet the diverse needs of individuals and businesses. The DMI Finance Loan Apply process is designed to be user-friendly, allowing applicants to access funds quickly and efficiently. The company specializes in personal loans, business loans, and home loans, catering to both salaried and self-employed individuals.

Understanding the nuances of the application process is crucial for potential borrowers, as it can significantly impact their financial journey. The application process typically begins with an online form that requires basic personal information, employment details, and financial status. DMI Finance employs advanced technology to streamline the application process, ensuring that it is not only quick but also secure.

Once the application is submitted, it undergoes a thorough review by the DMI Finance team, which assesses the applicant’s creditworthiness and financial history. This initial evaluation is critical, as it determines the loan amount and terms that the applicant may qualify for.

Key Takeaways

- DMI Finance Loan Apply is a convenient and hassle-free way to access financial assistance for various needs.

- The benefits of DMI Finance Loan Apply include quick approval, flexible repayment options, and competitive interest rates.

- Eligibility criteria for DMI Finance Loan Apply typically include age, income, employment status, and credit history.

- Applying for DMI Finance Loan is a simple process that can be done online or through a branch visit.

- Documents required for DMI Finance Loan Apply usually include proof of identity, address, income, and employment.

Benefits of DMI Finance Loan Apply

Fast Disbursal of Funds

One of the primary advantages of applying for a loan through DMI Finance is the speed at which funds can be disbursed. In many cases, approved applicants can receive their loan amount within a few hours or days, depending on the type of loan and the completeness of their documentation. This rapid turnaround time is particularly advantageous for individuals facing urgent financial needs, such as medical emergencies or unexpected expenses.

Competitive Interest Rates

DMI Finance offers competitive interest rates compared to many traditional banks and financial institutions. This affordability makes it an attractive option for borrowers looking to minimize their repayment burden.

Flexible Repayment Options

Furthermore, DMI Finance provides flexible repayment options, allowing borrowers to choose a tenure that aligns with their financial capabilities. This flexibility can significantly ease the pressure on borrowers, enabling them to manage their finances more effectively while repaying their loans.

Eligibility Criteria for DMI Finance Loan Apply

To qualify for a loan from DMI Finance, applicants must meet specific eligibility criteria that ensure they are capable of repaying the borrowed amount. Generally, applicants must be at least 21 years old and not exceed 60 years of age at the time of loan maturity. This age requirement ensures that borrowers are in a stable phase of their lives, both personally and professionally.

In addition to age, DMI Finance evaluates the applicant’s income level and employment status. Salaried individuals typically need to provide proof of stable employment with a minimum monthly income threshold, while self-employed individuals must demonstrate consistent earnings over a specified period. Credit history also plays a significant role in the eligibility assessment; a good credit score can enhance an applicant’s chances of approval and may even lead to more favorable loan terms.

How to Apply for DMI Finance Loan

| Loan Type | Eligibility Criteria | Interest Rate | Tenure |

|---|---|---|---|

| Personal Loan | Minimum age of 21 years, minimum income requirement | Starting from 11.49% | Up to 5 years |

| Business Loan | Minimum turnover, business vintage of at least 3 years | Starting from 13.50% | Up to 3 years |

| Home Loan | Minimum age of 21 years, minimum income requirement | Starting from 6.75% | Up to 30 years |

Applying for a loan with DMI Finance is a straightforward process that can be completed online or through physical branches. The online application method is particularly popular due to its convenience and efficiency. To begin, applicants need to visit the official DMI Finance website and navigate to the loan application section.

Here, they will find an online form that requires them to input personal details such as name, contact information, income level, and employment status. Once the form is filled out, applicants must submit it along with any required documentation. After submission, DMI Finance’s team will review the application and may reach out for additional information or clarification if necessary.

Following this review process, applicants will receive a notification regarding their loan approval status. If approved, they will be provided with details about the loan amount, interest rate, and repayment terms before finalizing the agreement.

Documents Required for DMI Finance Loan Apply

The documentation required for applying for a loan with DMI Finance varies depending on the type of loan and the applicant’s employment status. However, there are several common documents that most applicants will need to provide. For salaried individuals, proof of income is essential; this typically includes recent salary slips, bank statements reflecting salary deposits, and an employment verification letter from their employer.

Self-employed individuals must furnish different documentation to establish their income stability. This may include income tax returns for the past two years, profit and loss statements, and bank statements showing business transactions. Additionally, all applicants are generally required to submit identity proof (such as an Aadhar card or passport), address proof (like utility bills or rental agreements), and photographs.

Ensuring that all documents are accurate and up-to-date can expedite the application process significantly.

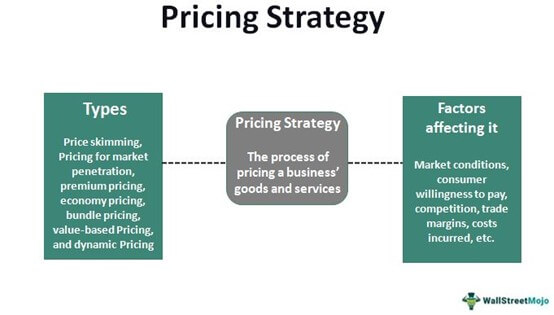

Interest Rates and Repayment Options

Interest rates on loans from DMI Finance are competitive within the market, making them an appealing choice for borrowers seeking affordable financing solutions. The exact interest rate offered can vary based on several factors including the applicant’s credit score, income level, and the type of loan being applied for. Typically, personal loans may have higher interest rates compared to secured loans like home loans due to the increased risk associated with unsecured lending.

Repayment options are designed to accommodate a wide range of financial situations. Borrowers can choose from various tenures that typically range from one year to five years or more, depending on the loan type. This flexibility allows borrowers to select a repayment plan that aligns with their financial capabilities and long-term goals.

Additionally, DMI Finance often provides options for prepayment or part-payment without hefty penalties, enabling borrowers to pay off their loans faster if they find themselves in a better financial position.

Tips for Maximizing Your Financial Potential with DMI Finance Loan

To make the most out of a DMI Finance loan, borrowers should consider several strategies that can enhance their financial outcomes. First and foremost, it is crucial to assess one’s financial needs accurately before applying for a loan. Borrowers should only apply for the amount they genuinely require rather than opting for larger sums that may lead to unnecessary debt burdens.

Another important tip is to maintain a good credit score prior to applying for a loan. A higher credit score not only increases the chances of approval but also opens doors to better interest rates and terms. Borrowers should regularly check their credit reports for inaccuracies and take steps to improve their scores by paying off existing debts on time.

Furthermore, once a loan is secured, borrowers should create a budget that incorporates their monthly repayments alongside other expenses. This proactive approach helps in managing finances effectively and ensures timely payments, which can further enhance creditworthiness over time.

FAQs about DMI Finance Loan Apply

Potential borrowers often have numerous questions regarding the DMI Finance Loan Apply process. One common query pertains to how long it takes for loan approval after submitting an application. Generally, DMI Finance aims to process applications swiftly; many applicants receive approval notifications within 24 hours if all documentation is in order.

Another frequently asked question revolves around whether there are any hidden charges associated with taking out a loan from DMI Finance. Transparency is a hallmark of DMI Finance’s operations; all fees related to processing, prepayment penalties, or late payment charges are clearly outlined in the loan agreement before signing. Lastly, many applicants wonder about the possibility of increasing their loan amount after approval.

While this may be feasible under certain conditions—such as improved credit scores or increased income—borrowers are encouraged to discuss this directly with DMI Finance representatives for tailored advice based on individual circumstances. In summary, understanding the intricacies of applying for a loan through DMI Finance can empower borrowers to make informed decisions that align with their financial goals. By leveraging competitive interest rates, flexible repayment options, and efficient application processes, individuals can navigate their financial journeys with greater confidence and clarity.

FAQs

What is DMI Finance?

DMI Finance is a non-banking financial company (NBFC) that provides various financial services including personal loans, business loans, and other financial products.

How can I apply for a loan with DMI Finance?

You can apply for a loan with DMI Finance by visiting their official website and filling out the online application form. You will need to provide personal and financial information as part of the application process.

What are the eligibility criteria for a loan with DMI Finance?

The eligibility criteria for a loan with DMI Finance may vary depending on the type of loan you are applying for. Generally, you will need to meet certain age, income, and credit score requirements.

What documents do I need to submit for a loan application with DMI Finance?

The documents required for a loan application with DMI Finance may include proof of identity, address, income, and bank statements. The specific documents needed will depend on the type of loan you are applying for.

How long does it take to get a loan approval from DMI Finance?

The time it takes to get a loan approval from DMI Finance may vary depending on the type of loan and the completeness of your application. In general, you can expect to receive a decision within a few days of submitting your application.

What are the interest rates and repayment terms for loans from DMI Finance?

The interest rates and repayment terms for loans from DMI Finance will vary depending on the type of loan and your individual financial profile. It is recommended to check their website or contact their customer service for specific details.