The advent of technology has revolutionized the way individuals approach personal finance, and one of the most significant innovations in this realm is the introduction of paperless personal loans. These loans offer a myriad of benefits that cater to the needs of modern borrowers. One of the most notable advantages is the convenience they provide.

With a paperless personal loan, applicants can complete the entire process from the comfort of their homes, eliminating the need for physical paperwork and in-person visits to financial institutions. This not only saves time but also reduces the stress associated with traditional loan applications, which often require extensive documentation and lengthy waiting periods. Moreover, paperless personal loans typically feature faster approval times compared to their traditional counterparts.

Many lenders utilize advanced algorithms and automated systems to assess creditworthiness and process applications swiftly. This means that borrowers can receive funds in their accounts within a matter of hours or days, rather than weeks. The speed of these transactions is particularly beneficial for individuals facing urgent financial needs, such as medical emergencies or unexpected repairs.

Additionally, the digital nature of these loans often leads to lower operational costs for lenders, which can translate into more competitive interest rates and favorable terms for borrowers.

Key Takeaways

- Paperless personal loans offer convenience and speed, with online applications and quick approval processes.

- To apply for a paperless personal loan, you can typically complete the entire process online, from filling out the application to submitting required documents.

- It’s important to carefully read and understand the terms and conditions of paperless personal loans, including interest rates, fees, and repayment schedules.

- Managing repayments for paperless personal loans involves setting up automatic payments or reminders to ensure timely payments and avoid late fees.

- When comparing different paperless personal loan options, consider factors such as interest rates, repayment terms, and any additional fees to find the best option for your financial needs.

How to Apply for a Paperless Personal Loan

Applying for a paperless personal loan is a straightforward process that can be completed online in just a few steps. The first step typically involves researching various lenders to find one that offers terms and conditions that align with your financial needs. Many financial institutions and online lenders provide user-friendly websites where potential borrowers can easily navigate through their offerings.

It is essential to compare interest rates, repayment terms, and any associated fees before making a decision. Once you have selected a lender, you will need to fill out an online application form. The application process usually requires basic personal information, including your name, address, income details, and Social Security number.

Some lenders may also ask for additional documentation, such as proof of income or employment verification, but this is often minimal compared to traditional loans. After submitting your application, the lender will review your information and perform a credit check. Depending on the lender’s policies, you may receive an instant decision or be notified within a few days.

If approved, you will receive a loan agreement outlining the terms, which you can review and sign electronically.

Understanding the Terms and Conditions of Paperless Personal Loans

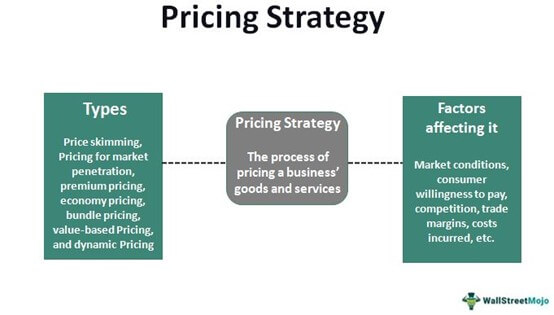

Before committing to a paperless personal loan, it is crucial to thoroughly understand the terms and conditions associated with it. This includes not only the interest rate but also the repayment schedule, any fees involved, and the total cost of borrowing over the life of the loan. Interest rates can vary significantly based on factors such as credit score, loan amount, and repayment term.

Borrowers should pay close attention to whether the interest rate is fixed or variable, as this can impact monthly payments and overall financial planning. Additionally, many lenders impose fees that can affect the total cost of the loan. These may include origination fees, late payment fees, or prepayment penalties.

It is essential to read the fine print carefully to avoid any surprises down the line. Understanding these terms will empower borrowers to make informed decisions and choose a loan that best fits their financial situation. Furthermore, being aware of the consequences of defaulting on a loan is vital; this could lead to additional fees, damage to credit scores, and potential legal action.

Managing Repayments for Paperless Personal Loans

| Metrics | Values |

|---|---|

| Number of Repayments | 500 |

| Repayment Frequency | Monthly |

| Repayment Amount | 200 |

| Repayment Method | Direct Debit |

Once you have secured a paperless personal loan, effective management of repayments becomes paramount to maintaining financial health. Setting up a repayment plan that aligns with your budget is essential. Many lenders offer flexible repayment options, allowing borrowers to choose between monthly or bi-weekly payments.

It is advisable to create a budget that accounts for these payments alongside other financial obligations to ensure timely repayments. In addition to budgeting, utilizing technology can significantly aid in managing loan repayments. Many lenders provide online portals or mobile apps where borrowers can track their payment schedules, view outstanding balances, and make payments directly from their accounts.

Setting up automatic payments can also help prevent missed deadlines and associated late fees. However, it is crucial to ensure that sufficient funds are available in your account on payment due dates to avoid overdraft charges.

Comparing Different Paperless Personal Loan Options

With numerous lenders offering paperless personal loans, it is vital for borrowers to compare different options before making a decision. Each lender may have unique features that cater to specific needs or preferences. For instance, some lenders may offer lower interest rates but have stricter eligibility criteria, while others may provide more lenient terms but at higher rates.

It is essential to evaluate these factors based on your financial situation and credit profile. Additionally, consider the overall customer experience when comparing lenders. Reading reviews and testimonials from previous borrowers can provide insights into the lender’s reliability and customer service quality.

Some platforms aggregate reviews specifically for financial products, allowing potential borrowers to gauge satisfaction levels among existing customers. Furthermore, checking if the lender offers any additional benefits—such as financial education resources or personalized support—can enhance your borrowing experience.

Tips for Using Paperless Personal Loans Responsibly

Using paperless personal loans responsibly is crucial for maintaining financial stability and avoiding debt traps. One key tip is to borrow only what you need rather than taking out larger amounts for unnecessary expenses. This approach not only minimizes repayment burdens but also reduces interest costs over time.

Before applying for a loan, assess your financial needs carefully and determine an appropriate loan amount that aligns with your budget. Another important aspect of responsible borrowing is understanding your repayment capacity before committing to a loan. Calculate your monthly income and expenses to ensure that you can comfortably accommodate loan repayments without compromising other essential financial obligations.

Additionally, consider building an emergency fund to cover unexpected expenses that may arise during the repayment period; this can help prevent reliance on additional borrowing in times of need.

Avoiding Common Pitfalls When Taking Out Paperless Personal Loans

While paperless personal loans offer numerous advantages, there are common pitfalls that borrowers should be aware of to avoid potential financial distress. One significant risk is falling into the trap of high-interest loans due to poor credit scores or lack of research. Borrowers should strive to improve their credit scores before applying for loans by paying down existing debts and ensuring timely bill payments.

This proactive approach can lead to better loan terms and lower interest rates. Another common pitfall is neglecting to read the fine print of loan agreements thoroughly. Many borrowers may overlook critical details regarding fees or repayment terms that could have significant implications later on.

It is essential to take the time to understand all aspects of the loan agreement before signing it. Additionally, being aware of potential predatory lending practices is crucial; some lenders may target vulnerable individuals with unfavorable terms disguised as attractive offers.

How Paperless Personal Loans Can Help Streamline Your Finances

Paperless personal loans can serve as powerful tools for streamlining finances when used judiciously. For individuals facing high-interest debt from credit cards or other loans, consolidating these debts into a single paperless personal loan can simplify repayment processes and potentially lower overall interest costs. By consolidating multiple payments into one manageable monthly payment, borrowers can reduce stress and improve their financial organization.

Furthermore, paperless personal loans can facilitate planned investments in education or home improvements that may yield long-term benefits. For instance, financing further education through a personal loan can enhance career prospects and earning potential over time. Similarly, investing in home renovations can increase property value and improve living conditions.

By strategically utilizing paperless personal loans for such purposes, individuals can create pathways toward greater financial stability and growth while maintaining control over their finances through efficient management practices.

FAQs

What is a paperless personal loan?

A paperless personal loan is a type of loan that can be applied for and processed entirely online, without the need for physical paperwork or documentation.

How does a paperless personal loan work?

To apply for a paperless personal loan, individuals can fill out an online application form and submit the required documents electronically. The lender will then review the application and documents, and if approved, disburse the loan amount directly to the borrower’s bank account.

What are the benefits of a paperless personal loan?

Some benefits of a paperless personal loan include convenience, faster processing times, reduced paperwork, and the ability to apply from anywhere with an internet connection. Additionally, paperless loans may also offer competitive interest rates and flexible repayment options.

What documents are typically required for a paperless personal loan?

The specific documents required for a paperless personal loan may vary by lender, but commonly requested documents include proof of identity, address, income, and bank statements. These documents can usually be submitted electronically as scanned copies or photos.

Are paperless personal loans secure?

Paperless personal loans are generally secure, as reputable lenders use encryption and other security measures to protect the personal and financial information of borrowers. It’s important for individuals to apply for loans through trusted and licensed financial institutions to ensure the security of their information.