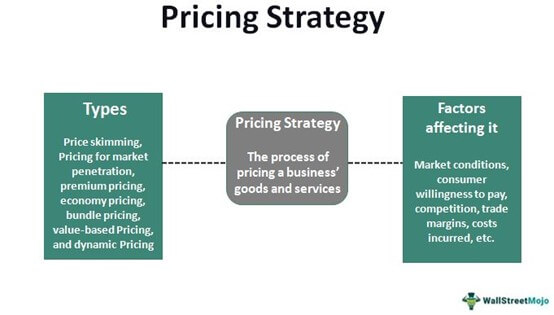

The HDFC Credit Card Rewards Program is designed to incentivize cardholders by offering a variety of rewards for their spending. This program is structured around a points system, where every transaction made using the card earns points that can be redeemed for various benefits. The accumulation of points varies based on the type of transaction; for instance, purchases made in specific categories such as dining, travel, or online shopping may yield higher points compared to regular transactions.

This tiered structure encourages cardholders to use their HDFC credit cards more frequently and strategically, maximizing their rewards potential. Moreover, HDFC offers a diverse range of credit cards, each tailored to different consumer needs and spending habits. For example, the HDFC Regalia Credit Card is particularly popular among frequent travelers due to its enhanced rewards on travel-related expenses and exclusive access to airport lounges.

On the other hand, the HDFC MoneyBack Credit Card is designed for everyday spenders, providing cashback on a wide array of purchases. Understanding the nuances of these offerings is crucial for cardholders to select the right card that aligns with their lifestyle and spending patterns, thereby optimizing their rewards experience.

Key Takeaways

- HDFC Credit Card Rewards Program offers various benefits such as cashback, travel benefits, dining privileges, and more.

- To earn more points and rewards, use the credit card for everyday expenses and take advantage of bonus point offers.

- Make the most of cashback offers by using the credit card for shopping, dining, and other eligible transactions.

- Leverage travel benefits and insurance coverage by booking flights and hotels using the credit card and understanding the coverage details.

- Utilize dining and entertainment privileges by using the credit card at partner restaurants and entertainment venues to earn extra rewards.

Tips for Earning More Points and Rewards

To maximize the benefits of the HDFC Credit Card Rewards Program, cardholders should adopt strategic spending habits. One effective approach is to focus on specific categories that offer higher reward points. For instance, many HDFC credit cards provide elevated points for transactions made in categories such as dining, travel bookings, and online shopping.

By channeling spending into these categories, cardholders can significantly increase their point accumulation. Additionally, keeping an eye on promotional offers can yield substantial rewards; HDFC frequently runs campaigns that provide bonus points for spending within certain time frames or on specific merchants. Another tip for earning more points is to utilize the card for recurring payments.

Setting up automatic bill payments for utilities, subscriptions, or insurance premiums can lead to a steady accumulation of points without requiring additional effort. Furthermore, cardholders should consider using their HDFC credit card for larger purchases rather than cash or debit cards. This not only helps in earning more points but also provides additional benefits such as purchase protection and extended warranties on certain items.

By being mindful of spending patterns and taking advantage of promotional opportunities, cardholders can enhance their rewards earning potential significantly.

Making the Most of Cashback Offers

Cashback offers are a prominent feature of many HDFC credit cards, providing cardholders with a percentage of their spending returned as cash. To fully leverage these offers, it is essential to understand the terms and conditions associated with them. Some cards may offer higher cashback rates for specific categories like groceries or fuel, while others may have a flat cashback rate across all transactions.

By aligning spending with these categories, cardholders can maximize their cashback earnings. For instance, using a card that offers 5% cashback on grocery purchases can lead to substantial savings over time if groceries constitute a significant portion of monthly expenses. Additionally, it is beneficial to stay updated on limited-time cashback promotions that HDFC frequently rolls out in partnership with various merchants.

These promotions often provide enhanced cashback rates for transactions made within a specified period or at select retailers. By planning purchases around these promotional periods, cardholders can effectively increase their cashback returns. Moreover, it’s advisable to regularly review account statements and cashback balances to ensure that no potential earnings are overlooked.

This proactive approach not only enhances financial awareness but also ensures that cardholders are making the most of the cashback opportunities available to them.

Leveraging Travel Benefits and Insurance Coverage

| Travel Benefits | Insurance Coverage |

|---|---|

| Flight discounts | Medical coverage |

| Hotel upgrades | Baggage loss protection |

| Car rental discounts | Trip cancellation insurance |

HDFC credit cards often come with a suite of travel benefits that can significantly enhance the travel experience for cardholders. Many cards offer complimentary airport lounge access, which provides a comfortable space to relax before flights. This benefit is particularly valuable for frequent travelers who may spend considerable time at airports.

Additionally, some HDFC cards provide discounts on flight bookings and hotel reservations when booked through specific travel partners. By utilizing these travel-related perks, cardholders can enjoy a more luxurious travel experience while also saving money. Insurance coverage is another critical aspect of HDFC credit cards that should not be overlooked.

Many cards come with complimentary travel insurance that covers unforeseen events such as trip cancellations, lost baggage, or medical emergencies while traveling. This added layer of security can provide peace of mind for travelers who may be concerned about potential mishaps during their journeys. It’s essential for cardholders to familiarize themselves with the specifics of the insurance coverage provided by their credit card, including any exclusions or limitations.

By understanding these details, travelers can make informed decisions and ensure they are adequately protected during their trips.

Utilizing Dining and Entertainment Privileges

Dining and entertainment privileges are among the most attractive features of HDFC credit cards, offering cardholders exclusive access to discounts and deals at various restaurants and entertainment venues. Many HDFC cards provide significant discounts at partner restaurants, allowing cardholders to enjoy fine dining experiences at reduced prices. For instance, some cards may offer up to 50% off on dining bills or special deals on buffet meals during weekends.

By taking advantage of these offers, cardholders can enjoy gourmet meals without straining their budgets. In addition to dining discounts, HDFC credit cards often include entertainment privileges such as discounted movie tickets or access to exclusive events. Cardholders can benefit from reduced ticket prices for popular movies or even early access to concert tickets for major events.

These perks not only enhance leisure activities but also encourage social outings without incurring excessive costs. To maximize these benefits, it’s advisable for cardholders to regularly check the HDFC website or mobile app for updated lists of partner restaurants and entertainment venues offering exclusive deals.

Maximizing Fuel Surcharge Waiver

Fuel expenses can be a significant part of monthly budgets for many individuals, making the fuel surcharge waiver offered by HDFC credit cards an attractive benefit. Most HDFC credit cards provide a waiver on fuel surcharges when transactions are made at select fuel stations. This waiver typically applies to transactions above a certain threshold amount and can lead to substantial savings over time, especially for those who frequently refuel their vehicles.

To maximize this benefit, cardholders should ensure they use their HDFC credit cards exclusively at partner fuel stations where the surcharge waiver is applicable. Additionally, keeping track of any promotional offers related to fuel purchases can further enhance savings; sometimes HDFC runs campaigns that offer additional rewards points or cashback on fuel transactions during specific periods. By being strategic about fuel purchases and utilizing the surcharge waiver effectively, cardholders can reduce their overall fuel expenses while enjoying the convenience of using their credit cards.

Taking Advantage of Shopping and Lifestyle Benefits

HDFC credit cards often come with an array of shopping and lifestyle benefits that cater to diverse consumer needs. Many cards offer exclusive discounts and deals at popular retail outlets and e-commerce platforms, allowing cardholders to save money while shopping for everyday essentials or luxury items alike. For instance, some HDFC credit cards may provide additional discounts during festive seasons or special sales events when shopping online or in-store at partner retailers.

Moreover, lifestyle benefits extend beyond mere discounts; many HDFC credit cards offer rewards points for every purchase made at retail outlets or online stores. This means that not only do cardholders save money through discounts but they also accumulate points that can be redeemed later for various rewards such as merchandise or travel vouchers. To fully leverage these shopping benefits, it’s advisable for cardholders to stay informed about ongoing promotions and seasonal sales that align with their shopping habits.

Managing and Redeeming Rewards Effectively

Effective management and redemption of rewards are crucial components of maximizing the benefits offered by the HDFC Credit Card Rewards Program. Cardholders should regularly monitor their rewards balance through the HDFC mobile app or online banking portal to stay updated on available points and any expiration dates associated with them. This proactive approach ensures that points do not go unused or expire without being redeemed.

When it comes to redeeming rewards, understanding the various options available is essential. HDFC typically offers multiple redemption avenues including merchandise from partner brands, travel bookings, gift vouchers, and even cashback into the account. Cardholders should evaluate which redemption option provides the best value based on their personal preferences and needs.

For instance, redeeming points for travel bookings might yield greater value compared to merchandise if one is planning a trip soon. Additionally, keeping an eye out for special redemption offers that provide bonus value or limited-time promotions can further enhance the rewards experience. By adopting these strategies and being mindful of how they utilize their HDFC credit cards, cardholders can significantly enhance their overall experience while maximizing rewards and benefits tailored to their lifestyle choices.

FAQs

How can I close my HDFC credit card?

To close your HDFC credit card, you can call the HDFC customer service number and request for the closure of your credit card. You can also visit the nearest HDFC branch and submit a written request for the closure of your credit card.

What are the documents required to close an HDFC credit card?

To close an HDFC credit card, you may be required to submit a written request for closure, along with your credit card and any outstanding dues to the nearest HDFC branch.

Can I close my HDFC credit card online?

Yes, you can close your HDFC credit card online by logging into your HDFC net banking account and submitting a request for the closure of your credit card.

Is there a fee for closing an HDFC credit card?

There may be a nominal fee for closing an HDFC credit card, which will be deducted from your credit card account at the time of closure.

What happens to the rewards points on my HDFC credit card when I close it?

If you close your HDFC credit card, any unredeemed rewards points on the card will be forfeited. It is advisable to redeem your rewards points before closing the credit card.