In an era where financial needs can arise unexpectedly, the Get Rupee Loan App emerges as a convenient solution for individuals seeking quick cash. This mobile application is designed to streamline the borrowing process, allowing users to access funds with minimal hassle. With its user-friendly interface and efficient processing, the app caters to a diverse audience, from students facing tuition fees to families managing unexpected medical expenses.

The Get Rupee Loan App stands out in the crowded fintech landscape by offering a seamless experience that prioritizes user convenience and accessibility. The app operates on a straightforward premise: it connects borrowers with lenders in a digital marketplace, facilitating quick loans without the traditional barriers associated with banks and financial institutions. Users can apply for loans directly from their smartphones, eliminating the need for lengthy paperwork and in-person visits.

This innovative approach not only saves time but also empowers individuals to take control of their financial situations with just a few taps on their devices. As the demand for instant financial solutions continues to grow, the Get Rupee Loan App positions itself as a reliable partner for those in need of immediate cash.

Key Takeaways

- Get Rupee Loan App is a convenient platform for quick cash loans

- Applying for a loan through the app is simple and fast

- Using the app offers benefits such as quick approval and flexible repayment options

- It is important to understand the terms and conditions of the loan before accepting it

- Repaying your loan on time is crucial to avoid additional fees and penalties

How to Apply for a Quick Cash Loan

Applying for a quick cash loan through the Get Rupee Loan App is designed to be an intuitive process that minimizes complexity. To begin, users must download the app from their respective app stores and create an account. This initial step typically requires basic personal information, such as name, contact details, and identification verification.

Once registered, users can navigate through the app’s features with ease, thanks to its well-organized layout. After setting up an account, users can proceed to apply for a loan by selecting their desired loan amount and repayment term. The app provides a clear overview of available options, allowing borrowers to make informed decisions based on their financial needs.

Users are then prompted to submit additional documentation, which may include proof of income or employment verification. The app employs advanced algorithms to assess creditworthiness quickly, ensuring that users receive timely feedback on their loan applications. This rapid processing time is one of the key advantages of using the Get Rupee Loan App, as it allows individuals to secure funds when they need them most.

Benefits of Using the Get Rupee Loan App

The Get Rupee Loan App offers numerous benefits that cater to the modern borrower’s needs. One of the most significant advantages is the speed at which loans are processed. Traditional lending institutions often require days or even weeks to approve loans, whereas the Get Rupee Loan App can provide approval within minutes.

This rapid turnaround is particularly beneficial for individuals facing urgent financial situations, such as medical emergencies or unexpected repairs. Another notable benefit is the flexibility in loan amounts and repayment terms. The app allows users to choose from a range of loan options tailored to their specific circumstances.

Whether someone needs a small amount for a short period or a larger sum for an extended duration, the app accommodates various financial requirements. Additionally, the transparent fee structure ensures that borrowers are fully aware of any associated costs before committing to a loan, fostering trust and confidence in the borrowing process.

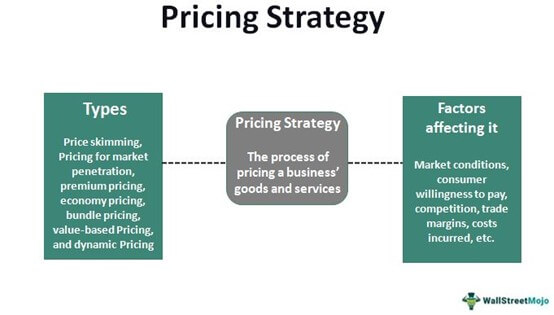

Understanding the Loan Terms and Conditions

| Loan Terms and Conditions | Metrics |

|---|---|

| Interest Rate | 3.5% |

| Loan Amount | 100,000 |

| Loan Term | 5 years |

| Repayment Schedule | Monthly |

Before committing to a loan through the Get Rupee Loan App, it is crucial for borrowers to thoroughly understand the terms and conditions associated with their loans. The app provides detailed information regarding interest rates, repayment schedules, and any applicable fees. Interest rates can vary based on factors such as creditworthiness and loan amount, so it is essential for users to review these details carefully.

Moreover, borrowers should pay close attention to the repayment terms outlined in their loan agreements. The app typically offers various repayment options, including weekly, bi-weekly, or monthly installments. Understanding these terms helps borrowers plan their finances effectively and avoid potential pitfalls associated with late payments or defaults.

By being well-informed about the loan’s conditions, users can make educated decisions that align with their financial capabilities.

Repaying Your Rupee Loan

Repaying a loan obtained through the Get Rupee Loan App is designed to be straightforward and user-friendly. The app provides multiple payment methods, allowing borrowers to choose the option that best suits their preferences. Users can make payments directly through the app using various methods such as bank transfers, credit cards, or digital wallets.

This flexibility ensures that borrowers can manage their repayments conveniently without facing unnecessary hurdles. Timely repayment is crucial not only for maintaining a good credit score but also for fostering a positive relationship with lenders within the app’s ecosystem. The Get Rupee Loan App often sends reminders and notifications regarding upcoming payment due dates, helping users stay on track with their financial obligations.

In cases where borrowers may encounter difficulties in making payments on time, it is advisable to communicate with customer support through the app. Many lenders are willing to work with borrowers facing temporary financial challenges by offering solutions such as extended repayment terms or restructuring payment plans.

Tips for Using the Get Rupee Loan App Responsibly

While the Get Rupee Loan App provides an accessible means of obtaining quick cash, responsible usage is paramount to avoid falling into a cycle of debt. One essential tip is to borrow only what is necessary. Users should assess their financial needs carefully and avoid taking out larger loans than required.

This approach not only minimizes repayment burdens but also reduces interest costs over time. Another important aspect of responsible borrowing is creating a budget that accounts for loan repayments alongside other financial obligations. By planning ahead and allocating funds for repayments within their monthly budget, borrowers can ensure they meet their obligations without straining their finances.

Additionally, users should familiarize themselves with the app’s features and tools that can assist in managing loans effectively, such as payment reminders and budgeting calculators.

Common FAQs about the Get Rupee Loan App

As with any financial service, potential users often have questions regarding the Get Rupee Loan App’s functionality and policies. One common inquiry pertains to eligibility requirements for obtaining a loan. Generally, applicants must be of legal age and provide proof of income or employment status.

The app may also consider credit history during the approval process; however, it aims to accommodate a wide range of credit profiles. Another frequently asked question revolves around the security measures implemented by the app to protect user data. The Get Rupee Loan App employs advanced encryption technologies and secure servers to safeguard personal information from unauthorized access.

Users can feel confident that their data is handled with care and in compliance with relevant privacy regulations.

Alternatives to the Get Rupee Loan App for Quick Cash

While the Get Rupee Loan App offers a compelling solution for quick cash needs, there are several alternatives available for individuals seeking financial assistance. Traditional banks and credit unions often provide personal loans; however, these options may involve more stringent eligibility criteria and longer processing times compared to mobile apps like Get Rupee. Peer-to-peer lending platforms represent another alternative worth considering.

These platforms connect borrowers directly with individual lenders willing to fund loans at competitive rates. While they may offer more personalized terms than traditional banks, borrowers should be aware of potential risks associated with relying on individual lenders. Additionally, some individuals may explore options such as payday loans or cash advances from credit cards; however, these alternatives often come with higher interest rates and fees that can lead to debt traps if not managed carefully.

Ultimately, it is essential for borrowers to evaluate all available options and choose a solution that aligns with their financial situation and repayment capabilities. In conclusion, while the Get Rupee Loan App provides an efficient and user-friendly platform for obtaining quick cash loans, understanding its features, benefits, and responsible usage practices is crucial for making informed financial decisions. By exploring various alternatives and being aware of potential pitfalls associated with borrowing, individuals can navigate their financial journeys more effectively.

FAQs

What is a rupee loan app?

A rupee loan app is a mobile application that allows users to apply for and receive loans in Indian rupees. These apps typically offer quick and convenient access to small, short-term loans for personal or business use.

How do rupee loan apps work?

Users can download a rupee loan app, create an account, and submit an application for a loan. The app will typically require personal and financial information, and may use algorithms to assess the user’s creditworthiness. Once approved, the loan amount is disbursed directly to the user’s bank account.

What are the benefits of using a rupee loan app?

Rupee loan apps offer convenience, speed, and accessibility. Users can apply for loans from the comfort of their own homes, and receive funds quickly, often within hours. These apps may also cater to individuals with limited or no credit history, providing access to credit that traditional banks may not offer.

What are the potential drawbacks of using a rupee loan app?

Some rupee loan apps may charge high interest rates and fees, making the cost of borrowing expensive. Additionally, users should be cautious of fraudulent or unlicensed loan apps that may misuse personal information or engage in predatory lending practices.

Are rupee loan apps regulated?

In India, rupee loan apps are regulated by the Reserve Bank of India (RBI) and must adhere to certain guidelines and regulations. Users should ensure that the loan app they choose is licensed and compliant with RBI regulations to protect their financial interests.