The APRTC CCS Loan Enquiry refers to a specific financial service offered by the Andhra Pradesh Road Transport Corporation (APRTC) that allows individuals to inquire about loans under the Concessional Credit Scheme (CCS). This scheme is designed to provide financial assistance to eligible individuals, particularly those associated with the transport sector, enabling them to acquire vehicles or enhance their business operations. The CCS aims to facilitate the growth of small businesses and promote entrepreneurship within the state, thereby contributing to the overall economic development of Andhra Pradesh.

The APRTC CCS Loan Enquiry serves as a vital resource for potential borrowers seeking information about loan options, interest rates, repayment terms, and eligibility criteria. By providing a structured platform for inquiries, APRTC ensures that applicants can make informed decisions regarding their financial needs. The process is designed to be user-friendly, allowing individuals to access necessary information quickly and efficiently.

This initiative not only supports the transport sector but also empowers individuals by providing them with the financial means to improve their livelihoods.

Key Takeaways

- APRTC CCS Loan Enquiry is a service provided by Andhra Pradesh Road Transport Corporation for employees to inquire about loans.

- To apply for APRTC CCS Loan Enquiry, employees need to fill out an application form and submit it along with the required documents.

- Eligibility criteria for APRTC CCS Loan Enquiry include being a permanent employee of APRTC and meeting certain service requirements.

- Documents required for APRTC CCS Loan Enquiry include ID proof, address proof, salary slips, and bank statements.

- Interest rates and repayment terms for APRTC CCS Loan Enquiry vary based on the loan amount and tenure, offering flexible options for employees.

How to apply for APRTC CCS Loan Enquiry

Applying for the APRTC CCS Loan Enquiry involves several straightforward steps that prospective borrowers must follow. Initially, individuals interested in the loan should visit the official APRTC website or designated offices where they can obtain detailed information about the loan scheme. The website typically contains a dedicated section for loan inquiries, where applicants can find relevant forms and guidelines.

It is advisable for applicants to familiarize themselves with the terms and conditions associated with the loan before proceeding. Once the applicant has gathered all necessary information, they can fill out the application form available online or at the APRTC office. This form usually requires personal details, including name, address, contact information, and specifics about the intended use of the loan.

After completing the form, applicants may need to submit it along with any required documentation. In some cases, APRTC may also offer a helpline or customer service support to assist applicants in navigating the process, ensuring that they have access to guidance throughout their application journey.

Eligibility criteria for APRTC CCS Loan Enquiry

To qualify for the APRTC CCS Loan, applicants must meet specific eligibility criteria set forth by the Andhra Pradesh Road Transport Corporation. Primarily, the scheme targets individuals involved in the transport sector, including drivers, operators, and small business owners who require financial assistance for vehicle acquisition or business expansion. Applicants are generally required to be residents of Andhra Pradesh and must demonstrate a clear understanding of their business operations and how the loan will benefit them.

Additionally, financial stability plays a crucial role in determining eligibility. Applicants may need to provide proof of income or existing business revenue to showcase their ability to repay the loan. The APRTC may also consider factors such as credit history and previous borrowing experiences when assessing an applicant’s eligibility.

By establishing these criteria, APRTC aims to ensure that loans are granted to individuals who are likely to utilize them effectively and responsibly, thereby minimizing default risks.

Documents required for APRTC CCS Loan Enquiry

| Document Type | Requirement |

|---|---|

| Identification Proof | Valid government-issued ID such as Aadhar card, Passport, or Driver’s License |

| Address Proof | Utility bill, Rental agreement, or Aadhar card with current address |

| Income Proof | Salary slips, Income tax returns, or bank statements |

| Employment Proof | Employment letter, Appointment letter, or company ID card |

| Loan Application Form | Complete and signed application form |

When applying for the APRTC CCS Loan Enquiry, applicants must prepare a set of essential documents that substantiate their identity, financial status, and business operations. Typically, these documents include proof of identity such as an Aadhar card or voter ID, which verifies the applicant’s residency in Andhra Pradesh. Additionally, applicants may need to provide proof of income, which could be in the form of salary slips, bank statements, or income tax returns that reflect their financial stability.

Furthermore, documentation related to the intended use of the loan is crucial. This may include quotations for vehicles or equipment that the applicant plans to purchase with the loan funds. If the applicant is already operating a business, they might also need to submit business registration documents or licenses that validate their operations within the transport sector.

Collectively, these documents help APRTC assess the applicant’s credibility and ensure that they meet all necessary requirements for loan approval.

Interest rates and repayment terms for APRTC CCS Loan Enquiry

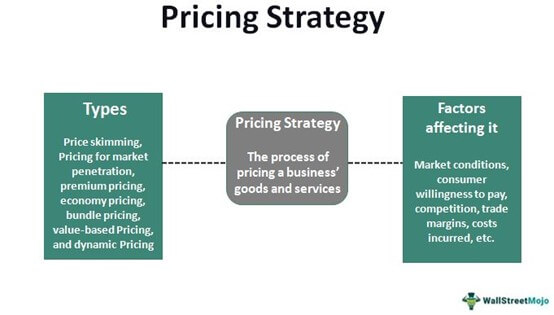

Interest rates and repayment terms are critical components of any loan agreement, and the APRTC CCS Loan is no exception. The interest rates offered under this scheme are typically competitive compared to other lending options available in the market. APRTC aims to provide affordable financing solutions that encourage individuals in the transport sector to invest in their businesses without being burdened by high-interest costs.

The exact interest rate may vary based on factors such as the applicant’s creditworthiness and prevailing market conditions. Repayment terms for the APRTC CCS Loan are designed to be flexible and manageable for borrowers. Generally, borrowers can expect a repayment period ranging from one to five years, depending on the loan amount and individual circumstances.

This flexibility allows borrowers to choose a repayment plan that aligns with their financial capabilities while ensuring that they can meet their obligations without undue stress. Additionally, APRTC may offer options for early repayment without penalties, providing borrowers with further financial freedom.

Benefits of APRTC CCS Loan Enquiry

The APRTC CCS Loan Enquiry offers numerous benefits that cater specifically to individuals in the transport sector. One of the primary advantages is access to affordable financing options that enable borrowers to acquire vehicles or expand their businesses without incurring excessive debt. This financial support can significantly enhance operational efficiency and productivity within the transport industry, ultimately contributing to economic growth in Andhra Pradesh.

Moreover, the streamlined application process and user-friendly inquiry system make it easier for potential borrowers to access information and apply for loans. This accessibility encourages more individuals to consider entrepreneurship within the transport sector, fostering innovation and competition. Additionally, by supporting small businesses through this loan scheme, APRTC plays a crucial role in job creation and community development, as successful businesses often lead to increased employment opportunities within local areas.

Frequently Asked Questions about APRTC CCS Loan Enquiry

As with any financial product, potential borrowers often have questions regarding the APRTC CCS Loan Enquiry. One common inquiry pertains to how long it takes for loan approval after submitting an application. Typically, APRTC aims to process applications promptly; however, approval times may vary based on factors such as document verification and applicant volume.

It is advisable for applicants to follow up with APRTC if they do not receive timely updates regarding their application status. Another frequently asked question revolves around what happens if a borrower defaults on their loan repayment. In such cases, APRTC may implement measures such as late fees or restructuring options to assist borrowers facing financial difficulties.

It is crucial for applicants to understand these implications before committing to a loan agreement fully. Additionally, many prospective borrowers seek clarification on whether they can apply for multiple loans under this scheme; while it may be possible under certain conditions, each application will be evaluated independently based on eligibility criteria.

Contact information for APRTC CCS Loan Enquiry

For individuals seeking further information about the APRTC CCS Loan Enquiry or wishing to initiate an application process, contacting APRTC directly is essential. The official website of Andhra Pradesh Road Transport Corporation provides comprehensive details about various services offered, including contact numbers and email addresses for customer support. Prospective borrowers can reach out via phone or email for personalized assistance regarding their inquiries.

Additionally, visiting local APRTC offices can provide face-to-face support where applicants can receive guidance from trained personnel who specialize in loan services. These representatives can help clarify any doubts regarding eligibility criteria, documentation requirements, and application procedures. By utilizing these contact avenues effectively, potential borrowers can ensure they have all necessary information at their disposal before proceeding with their loan applications under the CCS scheme.

FAQs

What is APSRTC CCS Loan Enquiry?

APSRTC CCS Loan Enquiry is a service provided by the Andhra Pradesh State Road Transport Corporation (APSRTC) for its employees to inquire about their Centralized Cashless Services (CCS) loans.

How can APSRTC employees inquire about their CCS loans?

APSRTC employees can inquire about their CCS loans by visiting the official APSRTC website or by contacting the APSRTC CCS loan department directly.

What information is required for APSRTC CCS loan enquiry?

To inquire about their CCS loans, APSRTC employees may need to provide their employee ID, personal details, and loan account information.

What is the purpose of APSRTC CCS loans?

APSRTC CCS loans are provided to employees for various purposes such as personal expenses, education, medical emergencies, and other financial needs.

Are APSRTC CCS loans available to all employees?

APSRTC CCS loans are typically available to permanent and temporary employees of APSRTC who meet the eligibility criteria set by the organization.

How can APSRTC employees repay their CCS loans?

APSRTC employees can repay their CCS loans through monthly installments deducted from their salaries or through other approved repayment methods.