The Xcite Ultra Credit Card has emerged as a popular choice among consumers seeking a blend of flexibility, rewards, and financial management. Designed with the modern user in mind, this credit card offers a variety of features that cater to diverse spending habits and lifestyles. With its competitive interest rates, no annual fee, and a robust rewards program, the Xcite Ultra Credit Card stands out in a crowded marketplace.

It appeals not only to frequent travelers but also to everyday shoppers who wish to maximize their purchasing power. One of the key selling points of the Xcite Ultra Credit Card is its user-friendly interface and mobile app, which allow cardholders to manage their accounts seamlessly. From tracking spending to monitoring rewards points, the digital tools provided enhance the overall user experience.

Additionally, the card’s security features, including fraud detection and zero liability for unauthorized transactions, provide peace of mind for users. As consumers increasingly prioritize both convenience and security in their financial transactions, the Xcite Ultra Credit Card positions itself as a reliable option.

Key Takeaways

- Xcite Ultra Credit Card offers a range of benefits and rewards for cardholders, making it a valuable financial tool.

- Understanding the rewards program is essential for maximizing the benefits of the Xcite Ultra Credit Card.

- Tips for maximizing rewards include taking advantage of bonus categories and using the card for everyday purchases.

- Using the Xcite Ultra Credit Card for everyday purchases can help cardholders earn rewards faster and more efficiently.

- Taking advantage of bonus categories can significantly increase the rewards earned with the Xcite Ultra Credit Card.

Understanding the Rewards Program

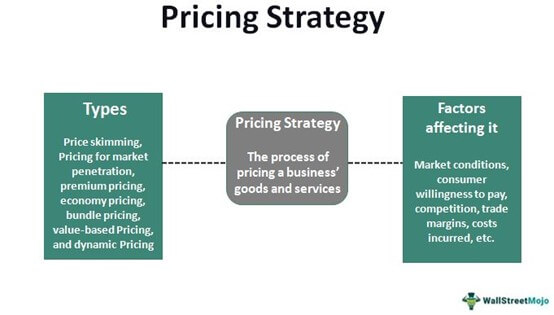

At the heart of the Xcite Ultra Credit Card is its rewards program, which is designed to incentivize cardholders for their everyday spending. The program operates on a points-based system, where users earn points for every dollar spent on eligible purchases. This straightforward approach allows cardholders to accumulate rewards quickly, making it easier to reach redemption thresholds.

The card typically offers higher point multipliers for specific categories such as dining, travel, and groceries, which can significantly enhance the earning potential for those who frequently spend in these areas. Moreover, the Xcite Ultra Credit Card often features promotional offers that allow users to earn bonus points during certain periods or on specific purchases. For instance, during holiday seasons or special events, cardholders may find opportunities to earn double or even triple points on select categories.

This dynamic aspect of the rewards program not only encourages strategic spending but also keeps users engaged with their credit card usage. Understanding these nuances can empower cardholders to make informed decisions about where and how they spend their money.

Tips for Maximizing Rewards

To truly capitalize on the benefits of the Xcite Ultra Credit Card, cardholders should adopt strategies that enhance their rewards accumulation. One effective approach is to familiarize oneself with the card’s bonus categories and promotional offers. By aligning spending habits with these categories, users can significantly increase their point earnings.

For example, if dining out earns double points during a promotional period, planning meals at restaurants that qualify can lead to substantial rewards over time. Another essential tip is to utilize the card for recurring expenses such as utility bills, subscriptions, and groceries. By charging these regular payments to the Xcite Ultra Credit Card, users can effortlessly accumulate points without altering their spending habits.

Additionally, setting up automatic payments can ensure that bills are paid on time while simultaneously earning rewards. This strategy not only maximizes point accumulation but also helps in maintaining a positive credit history by ensuring timely payments.

Using the Xcite Ultra Credit Card for Everyday Purchases

| Category | Details |

|---|---|

| Annual Fee | 0 |

| Interest Rate | 15.99% |

| Rewards | 1.5% cash back on all purchases |

| Introductory Offer | 0% APR for the first 12 months |

| Foreign Transaction Fee | 3% |

The versatility of the Xcite Ultra Credit Card makes it an ideal choice for everyday purchases. Whether it’s filling up the gas tank, grocery shopping, or dining out with friends, using this credit card can turn routine expenses into rewarding experiences. The card’s acceptance at a wide range of merchants ensures that users can earn points on virtually all their purchases.

This broad usability is particularly advantageous for those who prefer a single card for all their transactions. Moreover, leveraging the Xcite Ultra Credit Card for everyday purchases can help users build a strong credit profile over time. Regular use of the card, coupled with responsible payment practices—such as paying off the balance in full each month—can positively impact credit scores.

This dual benefit of earning rewards while enhancing creditworthiness makes the Xcite Ultra Credit Card an appealing option for consumers looking to optimize their financial health.

Taking Advantage of Bonus Categories

One of the standout features of the Xcite Ultra Credit Card is its bonus categories that change periodically throughout the year. These categories often include popular spending areas such as travel, dining, and entertainment. By staying informed about these rotating categories, cardholders can strategically plan their purchases to maximize their rewards potential.

For instance, if travel-related expenses earn extra points during a specific quarter, planning a vacation or booking travel accommodations during that time can yield significant rewards. Additionally, some cardholders may find it beneficial to track their spending patterns and adjust their usage accordingly when bonus categories change. For example, if a new category focuses on online shopping or streaming services, users can shift their spending habits to take full advantage of these enhanced earning opportunities.

This proactive approach not only maximizes rewards but also encourages users to engage more deeply with their credit card benefits.

Redeeming Rewards for Maximum Value

Once cardholders have accumulated a substantial number of points through their spending habits, understanding how to redeem those rewards effectively becomes crucial. The Xcite Ultra Credit Card typically offers various redemption options, including cash back, gift cards, travel bookings, and merchandise purchases. However, not all redemption methods provide equal value; therefore, it is essential for users to evaluate which options yield the highest return on their points.

For instance, redeeming points for travel-related expenses often provides greater value compared to cash back or merchandise redemptions. Many credit cards offer bonus value when points are used for travel bookings through their affiliated platforms or partners. By taking advantage of these opportunities, cardholders can stretch their rewards further and enjoy enhanced travel experiences without incurring additional costs.

Additionally, keeping an eye on limited-time offers or promotions can lead to even more lucrative redemption opportunities.

Managing Your Xcite Ultra Credit Card Account

Effective management of the Xcite Ultra Credit Card account is vital for maximizing its benefits and maintaining financial health. The user-friendly mobile app and online portal provide tools for tracking spending patterns, monitoring rewards accumulation, and managing payments efficiently. Regularly reviewing account statements can help users identify spending trends and adjust their habits accordingly to align with their financial goals.

Furthermore, setting up alerts for payment due dates and spending limits can prevent overspending and ensure timely payments. Many users find it helpful to establish a budget that incorporates credit card usage while keeping track of how much they are earning in rewards versus how much they are spending. This disciplined approach not only enhances financial management but also fosters responsible credit usage—an essential aspect of maintaining a healthy credit score.

Making the Most of Your Xcite Ultra Credit Card

In conclusion, the Xcite Ultra Credit Card offers a wealth of opportunities for consumers looking to enhance their purchasing power while enjoying valuable rewards. By understanding its rewards program and implementing strategies to maximize point accumulation and redemption value, cardholders can significantly benefit from their credit card usage. Whether it’s through everyday purchases or taking advantage of bonus categories, this credit card serves as a versatile tool in managing finances effectively.

Ultimately, responsible management of the Xcite Ultra Credit Card account is key to reaping its full benefits. By staying informed about promotional offers and utilizing digital tools for account management, users can navigate their financial landscape with confidence and ease. As consumers continue to seek ways to optimize their spending and rewards potential, the Xcite Ultra Credit Card remains a compelling option in today’s competitive credit market.

FAQs

What is the xcite ultra credit card?

The xcite ultra credit card is a credit card offered by xcite, a leading retail brand in the Middle East. It is designed to provide customers with exclusive benefits and rewards when making purchases at xcite stores and online.

What are the benefits of the xcite ultra credit card?

The xcite ultra credit card offers a range of benefits, including cashback on purchases, exclusive discounts at xcite stores, and access to special promotions and offers. Cardholders also have the option to convert their purchases into easy monthly installments.

How can I apply for the xcite ultra credit card?

Customers can apply for the xcite ultra credit card online through the xcite website or by visiting a xcite store. The application process typically requires proof of identity, income, and other financial information.

What are the eligibility criteria for the xcite ultra credit card?

The eligibility criteria for the xcite ultra credit card may vary, but generally, applicants must meet certain income requirements and have a good credit history. Other factors, such as employment status and residency, may also be taken into consideration.

Is there an annual fee for the xcite ultra credit card?

The xcite ultra credit card may have an annual fee, which varies depending on the cardholder’s credit limit and other factors. Some credit cards may offer a waiver of the annual fee for the first year or for customers who meet certain spending requirements.

What is the interest rate for the xcite ultra credit card?

The interest rate for the xcite ultra credit card may vary depending on the cardholder’s creditworthiness and other factors. It is important for cardholders to carefully review the terms and conditions of the card to understand the applicable interest rates and fees.