The SSR Movies Loan is a specialized financial product designed to support filmmakers in bringing their creative visions to life. This loan is tailored specifically for the film industry, providing funding for various stages of production, from pre-production through to post-production and marketing. The SSR Movies Loan is typically offered by financial institutions that understand the unique challenges and cash flow cycles associated with film production.

Unlike traditional loans, which may require extensive collateral or credit history, SSR Movies Loans often consider the potential of the film project itself as a key factor in the lending decision. The mechanics of how the SSR Movies Loan works are relatively straightforward. Filmmakers submit a detailed proposal outlining their project, including a budget, timeline, and marketing strategy.

The lender evaluates the proposal based on its feasibility, market potential, and the filmmaker’s track record. If approved, the loan amount is disbursed in stages, often aligned with specific milestones in the production process. This structure allows filmmakers to manage their cash flow effectively while ensuring that funds are used appropriately throughout the project lifecycle.

Additionally, some lenders may offer flexible repayment terms that align with the film’s revenue generation timeline, making it easier for filmmakers to manage their financial obligations.

Key Takeaways

- SSR Movies Loan is a financing option specifically designed for independent filmmakers to fund production, marketing, and distribution of their films.

- Filmmakers need to assess their financial needs and eligibility for SSR Movies Loan by considering factors such as budget, project scope, and market potential.

- When preparing a film proposal and budget for SSR Movies Loan application, it’s important to provide detailed information about the project, including production costs, marketing strategies, and distribution plans.

- Navigating the application process for SSR Movies Loan involves submitting a comprehensive package that includes the film proposal, budget, and other required documentation.

- To secure funding through SSR Movies Loan, filmmakers should focus on presenting a strong and compelling application that demonstrates the potential for commercial success and artistic merit.

Assessing Your Film’s Financial Needs and Eligibility for SSR Movies Loan

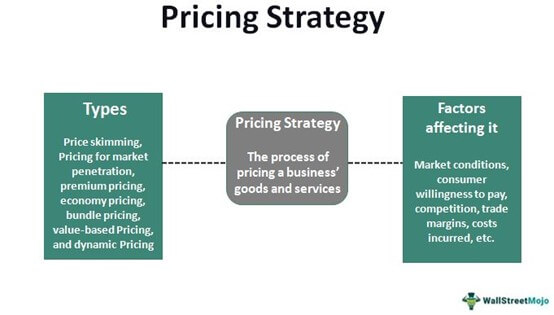

Before applying for an SSR Movies Loan, it is crucial for filmmakers to conduct a thorough assessment of their financial needs. This involves not only estimating the total budget required for the film but also breaking down costs into specific categories such as pre-production, production, post-production, and marketing. Understanding these financial needs helps filmmakers create a realistic budget that reflects the true costs associated with their project.

For instance, a filmmaker might need to account for expenses such as location fees, equipment rentals, cast and crew salaries, and marketing campaigns. By having a clear picture of these costs, filmmakers can present a compelling case to potential lenders. Eligibility for an SSR Movies Loan can vary significantly depending on the lender’s criteria.

Generally, lenders look for projects that demonstrate strong market potential and a well-defined target audience. Filmmakers should be prepared to provide evidence of their project’s viability, which may include market research, audience analysis, and comparable film performance data. Additionally, lenders may consider the filmmaker’s experience and past successes in the industry.

For example, a filmmaker with a history of producing successful films may have an easier time securing funding than a newcomer without a proven track record. Therefore, it is essential for filmmakers to not only assess their financial needs but also to understand the specific eligibility requirements set forth by potential lenders.

Preparing Your Film Proposal and Budget for SSR Movies Loan Application

Crafting a compelling film proposal is a critical step in securing an SSR Movies Loan. A well-structured proposal should clearly articulate the film’s concept, genre, target audience, and unique selling points. Filmmakers should aim to convey their passion for the project while also demonstrating its commercial viability.

This includes providing a synopsis of the story, character descriptions, and an overview of the intended production style. Additionally, filmmakers should highlight any notable talent attached to the project, such as well-known actors or experienced crew members, as this can enhance the project’s credibility in the eyes of potential lenders. Alongside the proposal, a detailed budget is essential for the loan application process.

The budget should be comprehensive and transparent, breaking down all anticipated costs associated with the film’s production. This includes not only direct costs like cast salaries and equipment rentals but also indirect costs such as insurance and contingency funds. Filmmakers should also consider including a marketing budget that outlines how they plan to promote the film upon its release.

A well-prepared budget not only demonstrates financial responsibility but also reassures lenders that the filmmaker has thoroughly considered all aspects of production and is prepared to manage funds effectively.

Navigating the Application Process for SSR Movies Loan

| Step | Description |

|---|---|

| 1 | Research SSR Movies loan options |

| 2 | Prepare necessary documents |

| 3 | Submit loan application |

| 4 | Wait for loan approval |

| 5 | Review and sign loan agreement |

| 6 | Receive loan funds |

The application process for an SSR Movies Loan can be intricate and requires careful attention to detail. Filmmakers must gather all necessary documentation to support their proposal and budget. This may include financial statements, tax returns, and any legal documents related to rights or intellectual property associated with the film.

Additionally, filmmakers should be prepared to provide a business plan that outlines how they intend to generate revenue from the film once it is completed. This could involve detailing distribution strategies, potential sales channels, and projected earnings based on similar films in the market. Once all documentation is compiled, filmmakers can submit their application to potential lenders.

It is advisable to approach multiple lenders to increase the chances of securing funding. Each lender may have different requirements or preferences regarding how applications are submitted and evaluated. Therefore, it is essential for filmmakers to tailor their applications accordingly.

After submission, filmmakers should be prepared for follow-up questions or requests for additional information from lenders as they assess the viability of the project. Maintaining open lines of communication during this phase can help build rapport with potential lenders and demonstrate professionalism.

Securing Funding for Your Film: Tips for a Successful SSR Movies Loan Application

To enhance the likelihood of securing funding through an SSR Movies Loan application, filmmakers should focus on several key strategies. First and foremost, presenting a clear and compelling narrative about the film can significantly impact how lenders perceive its potential success. Filmmakers should emphasize what makes their project unique and why it will resonate with audiences.

This narrative should be woven throughout both the proposal and budget documents to create a cohesive story that captures the lender’s interest. Another important tip is to build relationships within the industry before applying for funding. Networking with other filmmakers, producers, and industry professionals can provide valuable insights into what lenders are looking for in a successful application.

Attending film festivals or industry events can also help filmmakers connect with potential investors or lenders who may be interested in supporting their projects. Additionally, seeking feedback on proposals from trusted peers or mentors can help identify areas for improvement before submission.

Utilizing SSR Movies Loan Funds for Production, Marketing, and Distribution

Once funding has been secured through an SSR Movies Loan, filmmakers must utilize these funds judiciously to ensure successful project completion. The allocation of funds should align closely with the budget outlined in the loan application. During production, it is crucial to monitor expenses closely and maintain accurate records of all financial transactions.

This not only helps keep the project on budget but also ensures compliance with any reporting requirements set forth by the lender. In addition to production costs, filmmakers should allocate funds for marketing and distribution efforts early in the process. A well-planned marketing strategy can significantly impact a film’s success upon release.

This may include creating promotional materials such as trailers, posters, and social media campaigns designed to generate buzz around the film. Furthermore, filmmakers should consider how they will distribute their film once completed—whether through traditional theatrical releases, streaming platforms, or film festivals—and allocate funds accordingly to maximize exposure and revenue potential.

Managing Repayment and Reporting Requirements for SSR Movies Loan

Managing repayment obligations is a critical aspect of handling an SSR Movies Loan effectively. Filmmakers should familiarize themselves with the specific terms of their loan agreement, including repayment schedules and interest rates. It is essential to plan ahead for these payments by forecasting potential revenue streams from the film’s release.

For instance, if a filmmaker anticipates that their film will generate income through box office sales or streaming royalties within a certain timeframe, they can align their repayment strategy accordingly. In addition to repayment management, filmmakers must also adhere to any reporting requirements set by their lender throughout the loan period. This may involve providing regular updates on production progress or financial performance metrics related to the film’s revenue generation efforts.

Maintaining transparency with lenders not only fosters trust but also ensures that filmmakers remain compliant with their loan agreements.

Exploring Alternative Funding Options for Your Film if SSR Movies Loan is not an Option

While SSR Movies Loans can provide valuable funding opportunities for filmmakers, there may be instances where this option is not feasible or available. In such cases, exploring alternative funding sources becomes essential. One popular avenue is crowdfunding platforms like Kickstarter or Indiegogo, where filmmakers can raise funds directly from supporters who are interested in their projects.

This approach not only provides financial backing but also helps build an audience before the film is even completed. Another alternative funding option includes seeking out grants specifically designed for filmmakers or arts organizations. Various foundations and government programs offer grants that do not require repayment, making them an attractive option for independent filmmakers looking to finance their projects without incurring debt.

Additionally, partnerships with production companies or co-productions can provide access to additional resources and funding opportunities while sharing risks associated with film production. By understanding these various funding avenues and being proactive in seeking out financial support, filmmakers can increase their chances of successfully bringing their projects to fruition—even when traditional financing options like SSR Movies Loans are not available.

FAQs

What is SSR Movies Loan?

SSR Movies Loan is a term that refers to the practice of borrowing money from a lender in order to finance the production of a film or movie. This type of loan is often used by filmmakers and production companies to cover the costs of pre-production, production, and post-production expenses.

How does SSR Movies Loan work?

SSR Movies Loan works by allowing filmmakers and production companies to borrow money from a lender in order to finance the various stages of film production. The loan is typically secured by the rights to the film itself, and the lender may also require additional collateral or guarantees to mitigate the risk of the loan.

Who can apply for SSR Movies Loan?

Filmmakers, production companies, and other entities involved in the film industry can apply for SSR Movies Loan. However, the eligibility criteria and requirements for obtaining a loan may vary depending on the lender and the specific circumstances of the film project.

What are the typical terms of SSR Movies Loan?

The terms of SSR Movies Loan can vary widely depending on the lender, the specific film project, and the financial circumstances of the borrower. However, typical terms may include the loan amount, interest rate, repayment schedule, collateral requirements, and any other conditions or covenants imposed by the lender.

What are the risks and benefits of SSR Movies Loan?

The risks of SSR Movies Loan include the potential for financial loss if the film project is not successful, as well as the obligation to repay the loan with interest. However, the benefits can include access to the necessary funds to produce a film, the potential for financial gain if the film is successful, and the opportunity to bring a creative vision to life on the big screen.