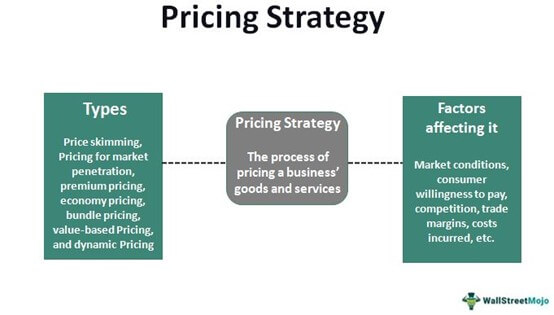

Credy Loan is a financial product designed to provide quick and accessible funding for individuals facing unexpected expenses or financial emergencies. This type of loan is particularly appealing to those who may not have access to traditional banking services or who require immediate cash flow. Credy operates primarily online, allowing borrowers to apply for loans from the comfort of their homes, which is a significant advantage in today’s fast-paced world.

The application process is streamlined, often requiring minimal documentation, which makes it an attractive option for many. One of the defining features of Credy Loans is their flexibility in terms of loan amounts and repayment periods. Borrowers can typically choose from a range of loan amounts, depending on their needs and financial situations.

This flexibility allows individuals to tailor their borrowing experience to fit their specific circumstances, whether they need a small amount for a short-term expense or a larger sum for more significant financial obligations. Additionally, the interest rates and fees associated with Credy Loans can vary, so it is essential for potential borrowers to read the terms carefully and understand the total cost of borrowing before committing.

Key Takeaways

- Credy Loan offers a flexible solution for unexpected expenses and can be used to consolidate debt.

- To apply for a Credy Loan, follow a step-by-step guide and ensure you meet the qualifying criteria.

- Managing your Credy Loan successfully requires careful budgeting and timely repayment.

- Credy Loan offers benefits such as quick approval, competitive interest rates, and flexible repayment options.

- When comparing Credy Loan with other lending options, consider factors such as interest rates, repayment terms, and eligibility requirements to make the right decision.

How to Apply for a Credy Loan: Step-by-Step Guide

Applying for a Credy Loan is designed to be a straightforward process, enabling borrowers to secure funds quickly. The first step typically involves visiting the Credy website, where potential borrowers can find detailed information about the loan products offered. After reviewing the options, applicants can select the loan amount they wish to request and the desired repayment period.

This initial selection is crucial as it sets the foundation for the entire borrowing experience. Once the loan amount and terms are chosen, the next step is to fill out an online application form. This form usually requires personal information such as name, address, income details, and employment status.

Some lenders may also ask for identification documents to verify the applicant’s identity. After submitting the application, borrowers can expect a prompt response regarding their approval status. Many lenders utilize automated systems to assess applications quickly, allowing for same-day approvals in many cases.

If approved, borrowers will receive a loan agreement outlining the terms and conditions, which they must review and sign before funds are disbursed.

Benefits of Credy Loan: Why It’s a Smart Choice

One of the primary benefits of a Credy Loan is its speed and convenience. In situations where time is of the essence—such as medical emergencies or urgent home repairs—having access to quick funding can be invaluable. Unlike traditional loans that may take days or even weeks to process, Credy Loans can often be approved within hours, with funds deposited directly into the borrower’s bank account shortly thereafter.

This immediacy can alleviate stress during challenging financial situations. Another significant advantage of Credy Loans is their accessibility. Many individuals who may struggle to qualify for conventional loans due to poor credit histories or lack of collateral find that Credy Loans offer a viable alternative.

The application process is generally less stringent, making it easier for a broader range of people to obtain financing. Additionally, the online nature of these loans means that borrowers can apply at any time without needing to visit a physical bank branch, further enhancing convenience.

Managing Your Credy Loan: Tips for Successful Repayment

| Loan Repayment Tips | Details |

|---|---|

| 1. Create a Budget | Track your income and expenses to ensure you can afford loan payments. |

| 2. Set Up Automatic Payments | Avoid missed payments by setting up automatic transfers from your bank account. |

| 3. Communicate with Lender | If you face financial difficulties, contact your lender to discuss options. |

| 4. Avoid Unnecessary Spending | Focus on essential expenses to free up funds for loan repayment. |

| 5. Monitor Your Credit Score | Ensure timely loan payments to maintain or improve your credit score. |

Successfully managing a Credy Loan requires careful planning and discipline. One effective strategy is to create a detailed budget that accounts for all monthly expenses, including the loan repayment. By understanding one’s financial landscape, borrowers can allocate funds appropriately and ensure that they have enough set aside each month to meet their repayment obligations.

This proactive approach can help prevent missed payments and the associated penalties that can arise from late repayments. Another important aspect of managing a Credy Loan is maintaining open communication with the lender. If borrowers anticipate difficulties in making payments on time, it is advisable to reach out to the lender as soon as possible.

Many lenders are willing to work with borrowers who proactively communicate their challenges, potentially offering solutions such as payment extensions or restructuring the loan terms. This dialogue can be crucial in avoiding default and maintaining a positive relationship with the lender.

Using Credy Loan to Consolidate Debt: A Wise Financial Move

Debt consolidation is a strategy that many individuals consider when faced with multiple outstanding debts, particularly those with high-interest rates. A Credy Loan can serve as an effective tool for this purpose by allowing borrowers to combine several debts into one manageable payment. By consolidating debts, individuals can often secure a lower interest rate than what they are currently paying on their existing debts, leading to significant savings over time.

For example, if an individual has several credit card debts with varying interest rates, taking out a Credy Loan to pay off those cards can simplify their financial situation. Instead of juggling multiple payments each month, they would only need to focus on repaying one loan. This not only streamlines finances but also reduces the risk of missing payments on multiple accounts, which can negatively impact credit scores.

However, it is essential for borrowers to ensure that they do not accumulate new debt after consolidating; otherwise, they may find themselves in an even more challenging financial position.

Credy Loan: A Flexible Solution for Unexpected Expenses

Unexpected expenses can arise at any moment—be it medical bills, car repairs, or urgent home maintenance needs—and having access to quick funding can make all the difference in managing these situations effectively. A Credy Loan provides a flexible solution that allows individuals to address these unforeseen costs without derailing their financial stability. The ability to choose loan amounts and repayment terms tailored to specific needs means that borrowers can find a solution that fits their unique circumstances.

Moreover, the online application process allows borrowers to access funds quickly when time is of the essence. For instance, if someone experiences a sudden car breakdown that requires immediate repair, applying for a Credy Loan can provide the necessary funds without delay. This flexibility not only helps in managing immediate financial pressures but also contributes to overall peace of mind knowing that there are options available when life throws unexpected challenges.

Qualifying for a Credy Loan: What You Need to Get Approved

Qualifying for a Credy Loan typically involves meeting certain criteria set by the lender. While specific requirements may vary between lenders, there are common factors that most will consider during the approval process. First and foremost, applicants usually need to be at least 18 years old and possess valid identification.

Proof of income is also essential; lenders want assurance that borrowers have the means to repay the loan. Credit history may play a role in the approval process as well, although many lenders offering Credy Loans are more lenient than traditional banks regarding credit scores. This accessibility means that individuals with less-than-perfect credit histories still have opportunities for approval.

However, it’s important for potential borrowers to be aware that higher-risk applicants may face higher interest rates or less favorable terms as compensation for the increased risk taken on by lenders.

Comparing Credy Loan with Other Lending Options: Making the Right Decision

When considering borrowing options, it’s crucial to compare Credy Loans with other available lending products such as personal loans from banks or credit unions, payday loans, and peer-to-peer lending platforms. Each option has its own set of advantages and disadvantages that should be carefully weighed based on individual financial situations and needs. For instance, traditional personal loans often come with lower interest rates compared to Credy Loans but may require more extensive documentation and longer processing times.

On the other hand, payday loans might offer quick cash but typically come with exorbitant interest rates and short repayment periods that can lead borrowers into cycles of debt if not managed properly. By evaluating these factors alongside personal circumstances—such as urgency for funds, creditworthiness, and repayment capabilities—borrowers can make informed decisions about which lending option best suits their needs. In conclusion, understanding the nuances of Credy Loans and how they fit into the broader landscape of lending options empowers individuals to make informed financial decisions tailored to their unique situations.

Whether addressing unexpected expenses or consolidating debt, being well-informed about available choices is essential in navigating today’s complex financial environment effectively.

FAQs

What is Credy loan?

Credy loan is a type of personal loan offered by Credy, a financial technology company. It is designed to provide individuals with quick and convenient access to funds for various personal needs.

How does Credy loan work?

To apply for a Credy loan, individuals can visit the Credy website or download the Credy app and fill out an online application. After submitting the required documents and information, Credy will assess the application and provide a loan offer with terms and conditions. If the offer is accepted, the funds will be disbursed to the borrower’s bank account.

What are the eligibility criteria for a Credy loan?

The eligibility criteria for a Credy loan may include factors such as the borrower’s age, income, credit history, and employment status. Credy may also consider other factors to determine the borrower’s creditworthiness.

What are the interest rates and fees for a Credy loan?

The interest rates and fees for a Credy loan may vary based on factors such as the borrower’s credit profile, loan amount, and repayment tenure. Credy will provide the borrower with a loan offer that includes the applicable interest rates and fees.

What are the repayment options for a Credy loan?

Credy offers flexible repayment options for its loans, allowing borrowers to choose a repayment tenure that suits their financial situation. Borrowers can make repayments through various channels such as bank transfers, online payments, or post-dated cheques.

Is Credy loan available for self-employed individuals?

Yes, Credy loan is available for both salaried and self-employed individuals, subject to meeting the eligibility criteria set by Credy.

How can I contact Credy for more information about their loan products?

Individuals can contact Credy through their website, customer support hotline, or email to inquire about their loan products and services.